Financially Sound

Get a straightforward, fast service on-the-go. One document is all you need

Get a straightforward, fast service on-the-go. One document is all you need

A direct lender that values responsibility and innovation. We ensure your data's security and help in hard situations

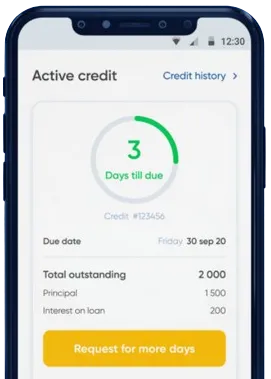

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Apply through the app by completing the necessary form.

Anticipate our decision, made swiftly in 15 minutes.

Accept your funds, normally transferred in about one minute.

Urgent loan have become an essential financial tool for many people in Nigeria who find themselves in urgent need of funds. In a country where financial stability can be a challenge for many individuals and families, urgent loan provide a quick and convenient solution to unforeseen expenses.

One of the main benefits of urgent loan in Nigeria is the quick access to funds. Many urgent loan providers in Nigeria offer same-day or next-day approval, allowing borrowers to get the money they need in a timely manner. This can be crucial in urgent situations, such as medical emergencies or unexpected home repairs.

Another benefit of urgent loan is the convenience they offer. With the rise of online loan providers, borrowers can now apply for urgent loan from the comfort of their own homes. This eliminates the need to visit physical bank branches and wait in long lines, making the loan application process much quicker and easier.

Furthermore, urgent loan in Nigeria often do not require any collateral, making them accessible to a wider range of borrowers. This is especially beneficial for individuals who do not have valuable assets to offer as security for a loan.

Urgent loan can be incredibly useful in various situations where immediate access to funds is necessary. For example, if a family member falls ill and requires medical treatment that is not covered by insurance, an urgent loan can help cover the expenses. Similarly, urgent loan can also be used to pay for school fees, start or expand a small business, or make home improvements.

Moreover, urgent loan can be a lifeline for individuals who find themselves facing unexpected financial crises, such as job loss or natural disasters. In such situations, urgent loan can provide the temporary financial support needed to overcome the challenges and get back on track.

Overall, urgent loan in Nigeria play a vital role in providing financial assistance to individuals and families in times of need. With their quick approval process, convenient application methods, and flexible repayment options, urgent loan have become a trusted resource for many Nigerians seeking immediate financial relief.

In conclusion, urgent loan in Nigeria offer numerous benefits and can be incredibly useful in a variety of urgent situations. Whether you need funds for medical expenses, education, business purposes, or emergency situations, urgent loan provide a quick and convenient solution. With their accessibility and flexibility, urgent loan have become an important tool for many Nigerians navigating the challenges of financial instability.

An urgent loan in Nigeria is a loan that is quickly processed and disbursed to the borrower in a short period of time, usually within 24 hours, to meet immediate financial needs.

Any individual who is a Nigerian citizen or resident, above the age of 18, and can provide proof of income and identity documents can apply for an urgent loan in Nigeria.

The requirements to qualify for an urgent loan in Nigeria typically include a clear proof of income, a valid identification document, a bank account, and sometimes a guarantor depending on the lender.

The loan amount that one can borrow with an urgent loan in Nigeria varies among lenders, but generally ranges from ₦5,000 to ₦500,000, based on the borrower's income and creditworthiness.

The interest rate for an urgent loan in Nigeria can vary depending on the lender and the borrower's credit history, but it typically ranges from 5% to 30% per month.

Once your loan application is approved, you can typically receive the funds from an urgent loan in Nigeria within 24 hours, either through bank transfer or cash pickup depending on the lender's disbursement method.